In SuccessFactors, processing HR Administration and Benefits management at the same time may sound like a good idea. But regardless of whether you use Payroll with SAP or have Benefits integrated to it, it is worth your time to read the various options offered by SAP.

As a professional HR consultant, my target for this blog is to examine the key differences between these solutions. I will be comparing the functionality and operations of both platforms using Basic Life Insurance as an example and hope to provide you with a reference for further discussions by the end of this article.

Time to compare the “benefits” of each solution

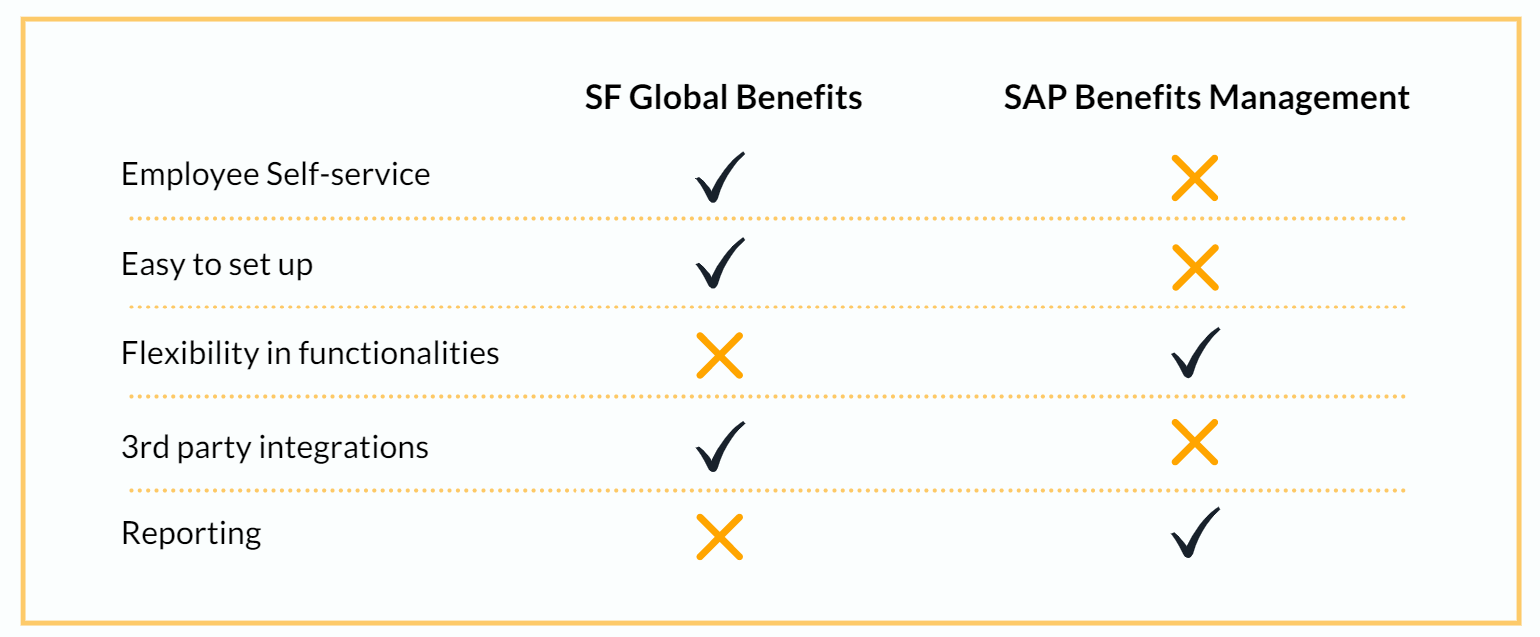

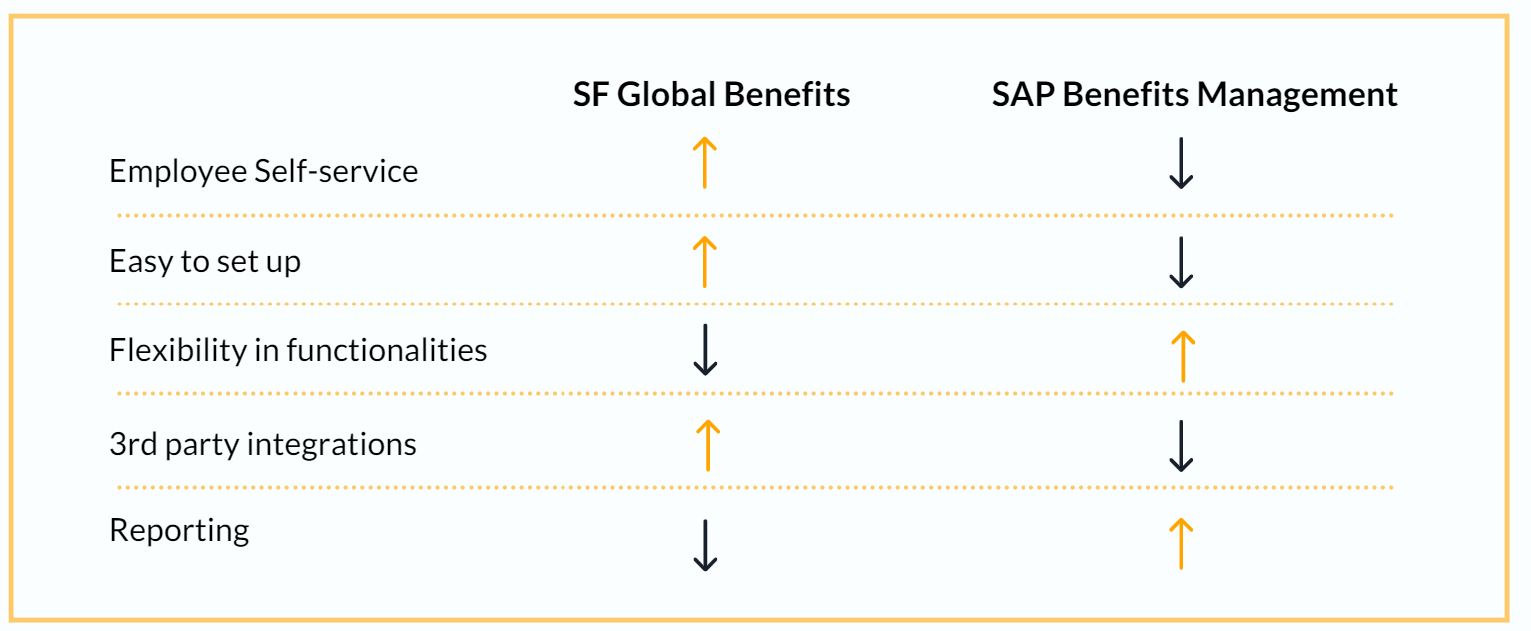

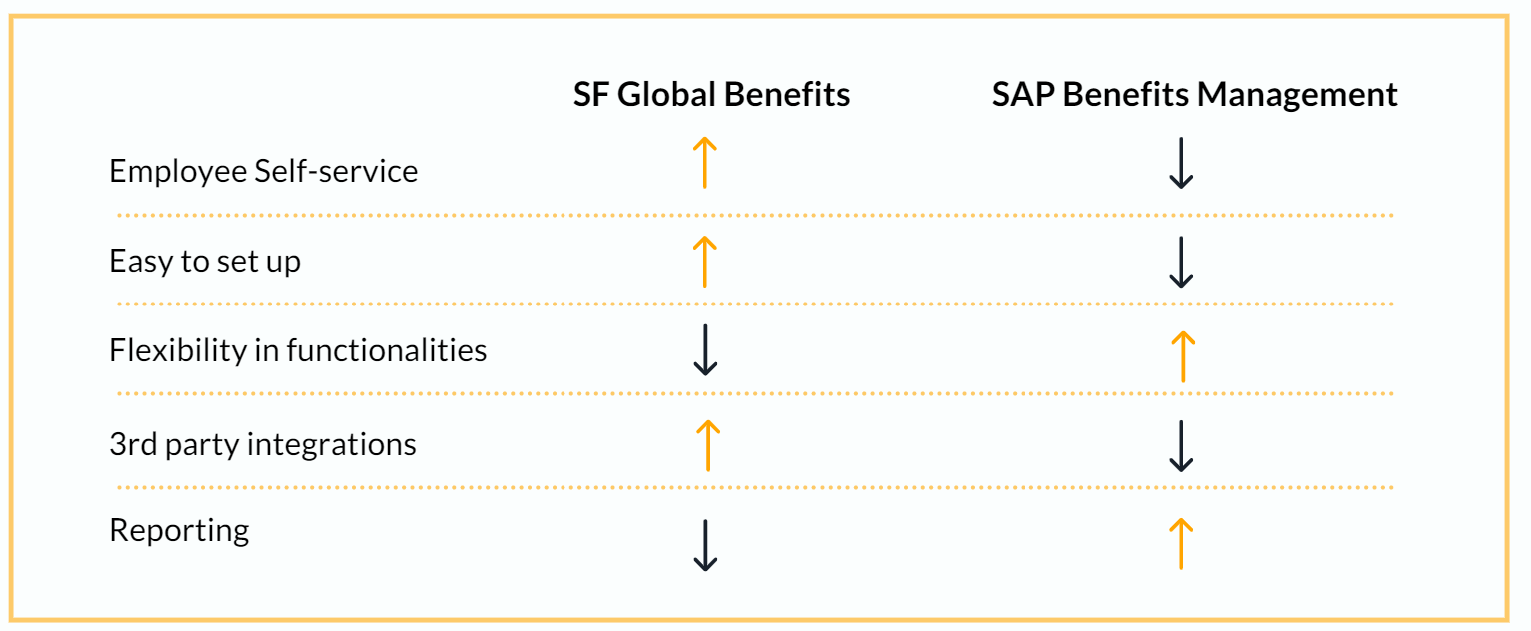

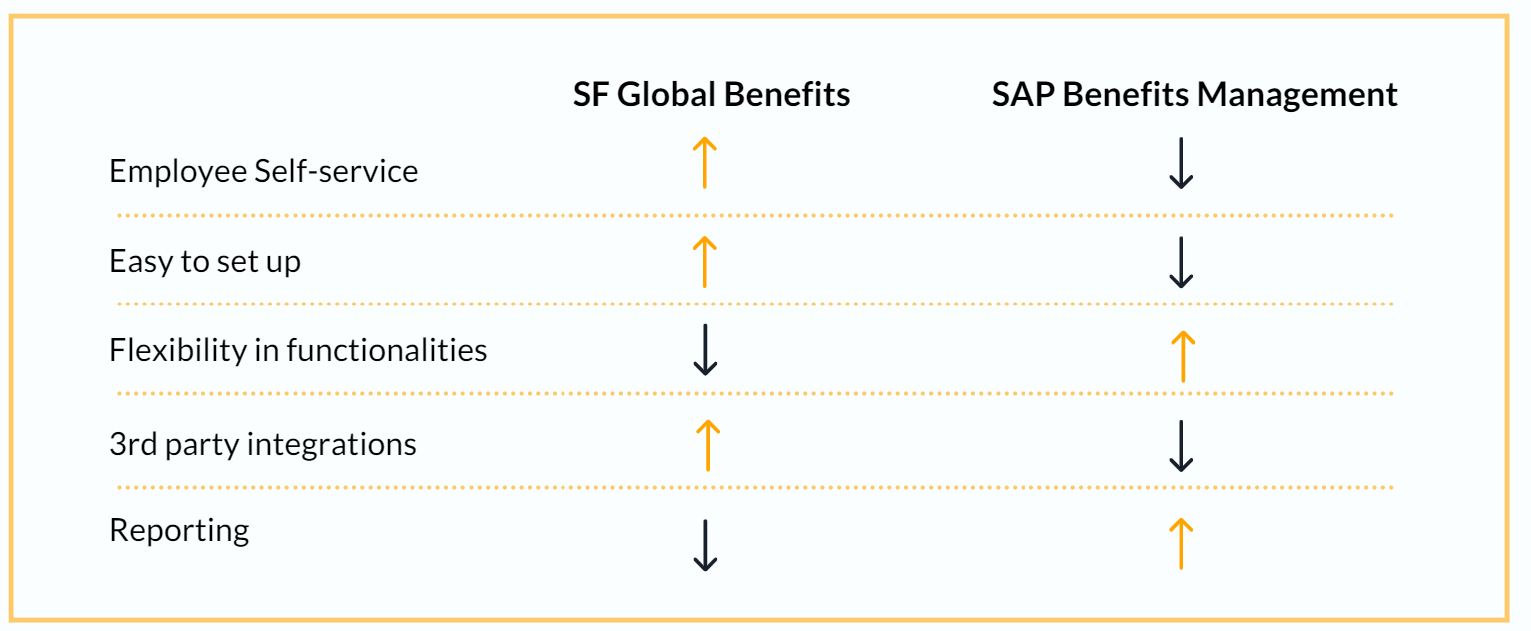

Let´s examine some key differences between both solutions in this interesting comparison exercise.

Let´s examine some key differences between both solutions in this interesting comparison exercise.

The SAP HCM solution is oriented for smooth HR department functionality compared to SuccessFactors which is fully focused on the employee experience. This is why the workflow functionality and intricate benefits details take precedence in the solution.

The SAP HCM solution is oriented for smooth HR department functionality compared to SuccessFactors which is fully focused on the employee experience. This is why the workflow functionality and intricate benefits details take precedence in the solution.

- The integration of the benefits master data in the SAP HCM solution is embedded in the Payroll component. Given that SuccessFactors data exists outside SAP, it is necessary to send the employee contributions data from Employee Central to SAP. The data will then be available in the Infotype 14 or 15 to be processed by SAP Payroll component.

- In terms of reporting tools for Benefits, both solutions offer standard reports. SAP offers reports to display either employee or benefits data. This data is grouped in different categories depending on the information type. There is also the option to build an ad-hoc request including the required information from the benefits master data. SuccessFactors offers six templates related to benefits, but depending on the data requirements it is possible to create your own reports in an easy way, using the advanced reporting tool.

- If the client requirement also includes 3rd party integrations, there are some pre-built integrations available in SuccessFactors with certain vendors (such as BenefitFocus, Thomsons and Aon Hewitt). Nevertheless, in SAP no standard integrations are available, so it would be necessary to create a custom integration using a middleware platform such as SAP CPI.

- To measure the implementation effort that is required, an SAP professional consultant might say that the SuccessFactors solution is faster to set up for flat benefits. It is however important to consider the multiple exceptions and complex business rules. It could be more difficult to manage and, in some cases, more limited for not having the option to create enhancements, compared to SAP Benefit Management which gives you more flexibility to handle complex scenarios.

*The chart pictured above is a qualitative analysis based on personal experience.

*The chart pictured above is a qualitative analysis based on personal experience.

Hopefully, this comparison helps you to have a better understanding of what is offered in both solutions and allows you to dive further into constructive discussion to take the best decision for your business.

Basic Life Insurance in SuccessFactors

As first step, one must define the Benefit specifying the benefit type, the legal entities allowed and how it will work for the enrollment of the benefit. Depending on benefit type, in the case of an insurance, it requires a lower layer of customizing to define the details, such as the frequency, insurance provider, coverages and the premium calculation.

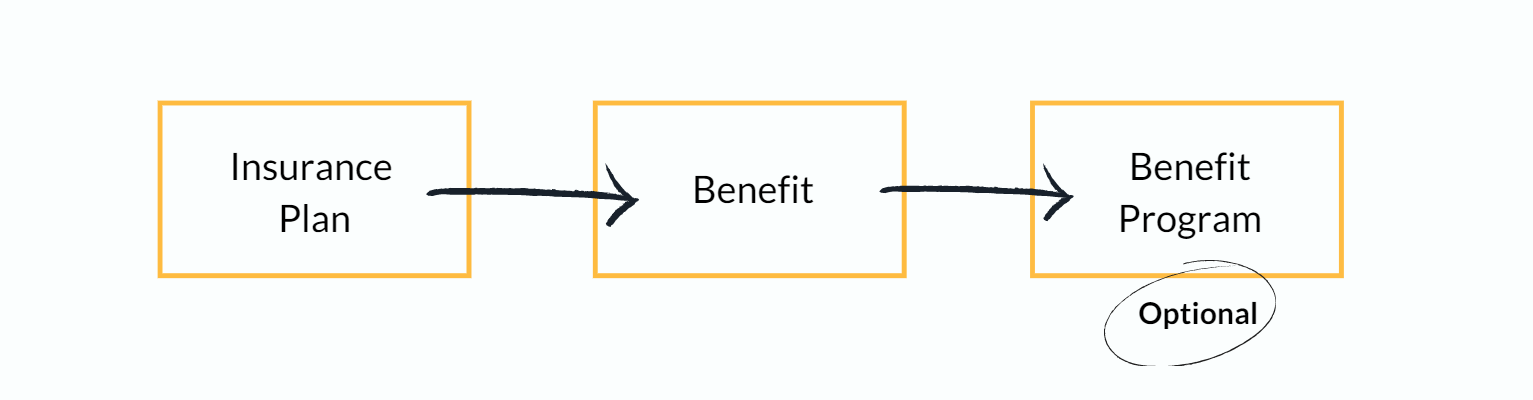

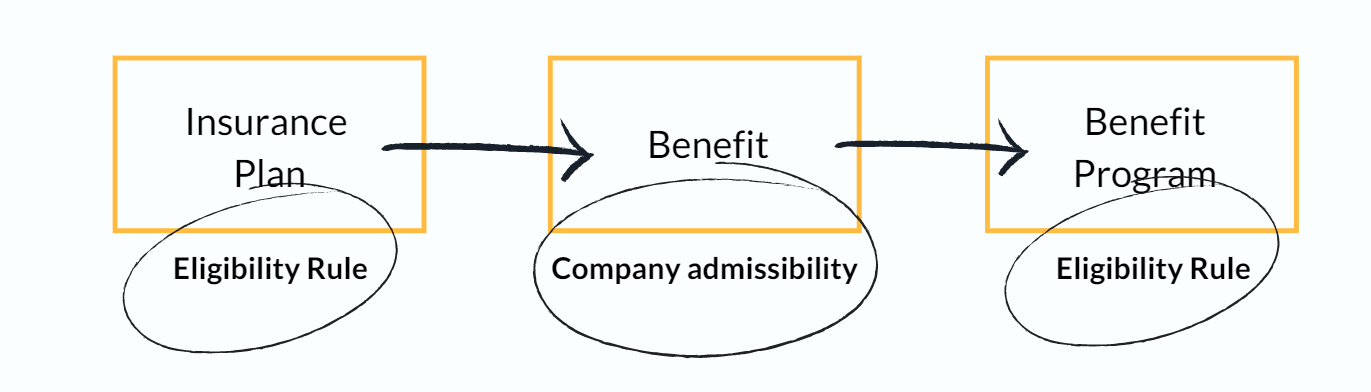

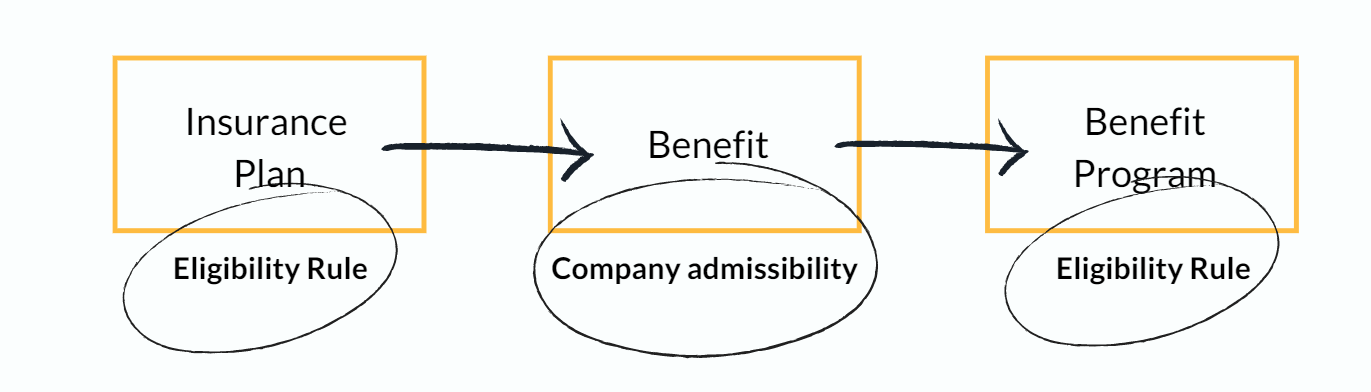

The employees can be enrolled directly to the Benefit, or alternately, the solution gives the possibility to create Programs (upper layer) which associate more than one Benefit and enroll the employees to them in one action.

The eligibility rules are going to run in the Insurance Plan level to select the coverage options, and/or in the Benefit Program level. In the Benefit object, we can set the admissibility only per Company.

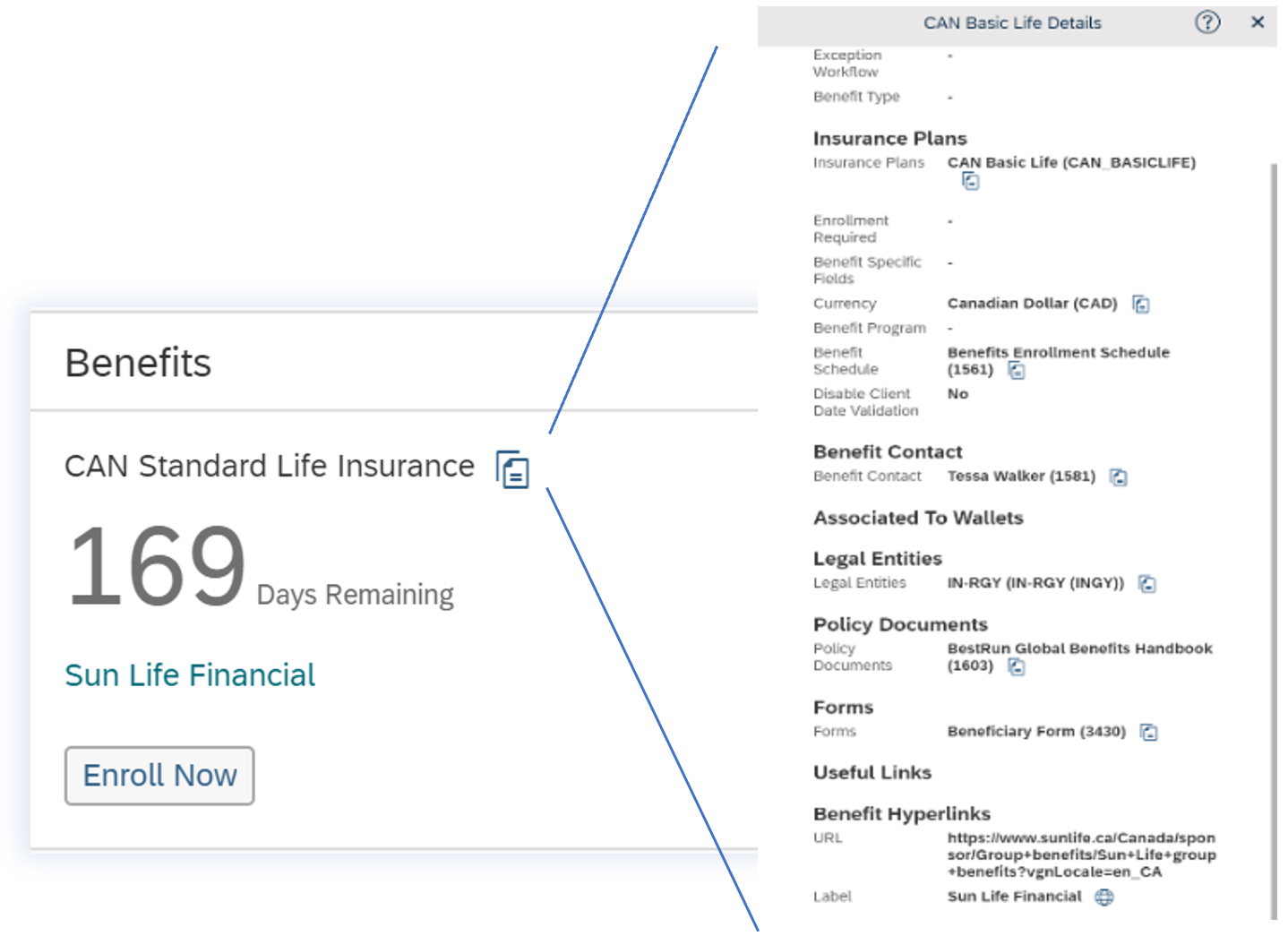

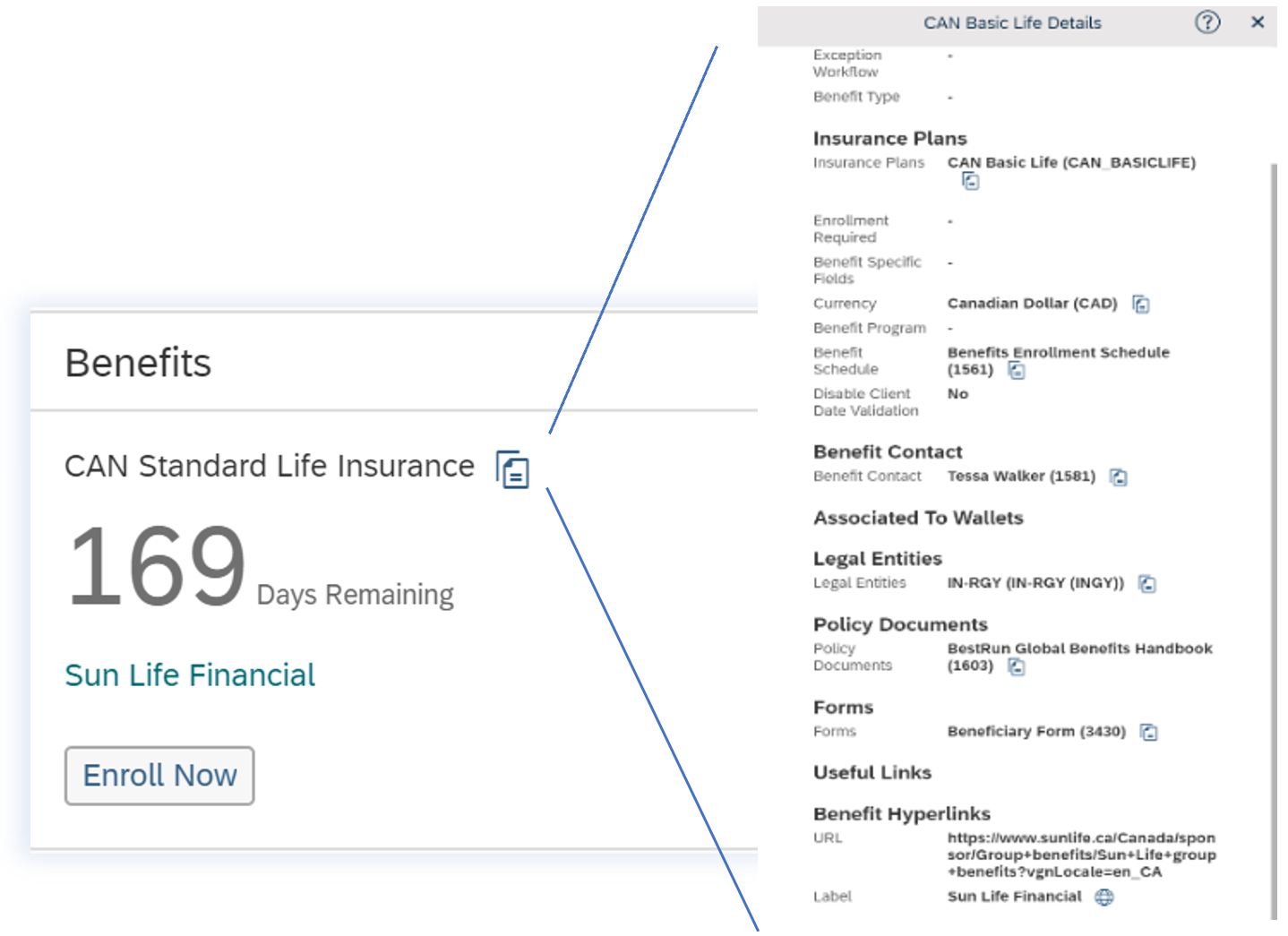

The process begins in the Benefits section for the People Profile. This immediately highlights all the Benefits and Benefit Programs for which employees can apply. Information found in this section includes but is not limited to, the remaining days to apply for each Benefit and the link to the Provider’s website.

To the right of the Benefit Name, we find an icon that displays information related to it. Examples include the insurance plan, currency, schedule, contact, provider, etc.

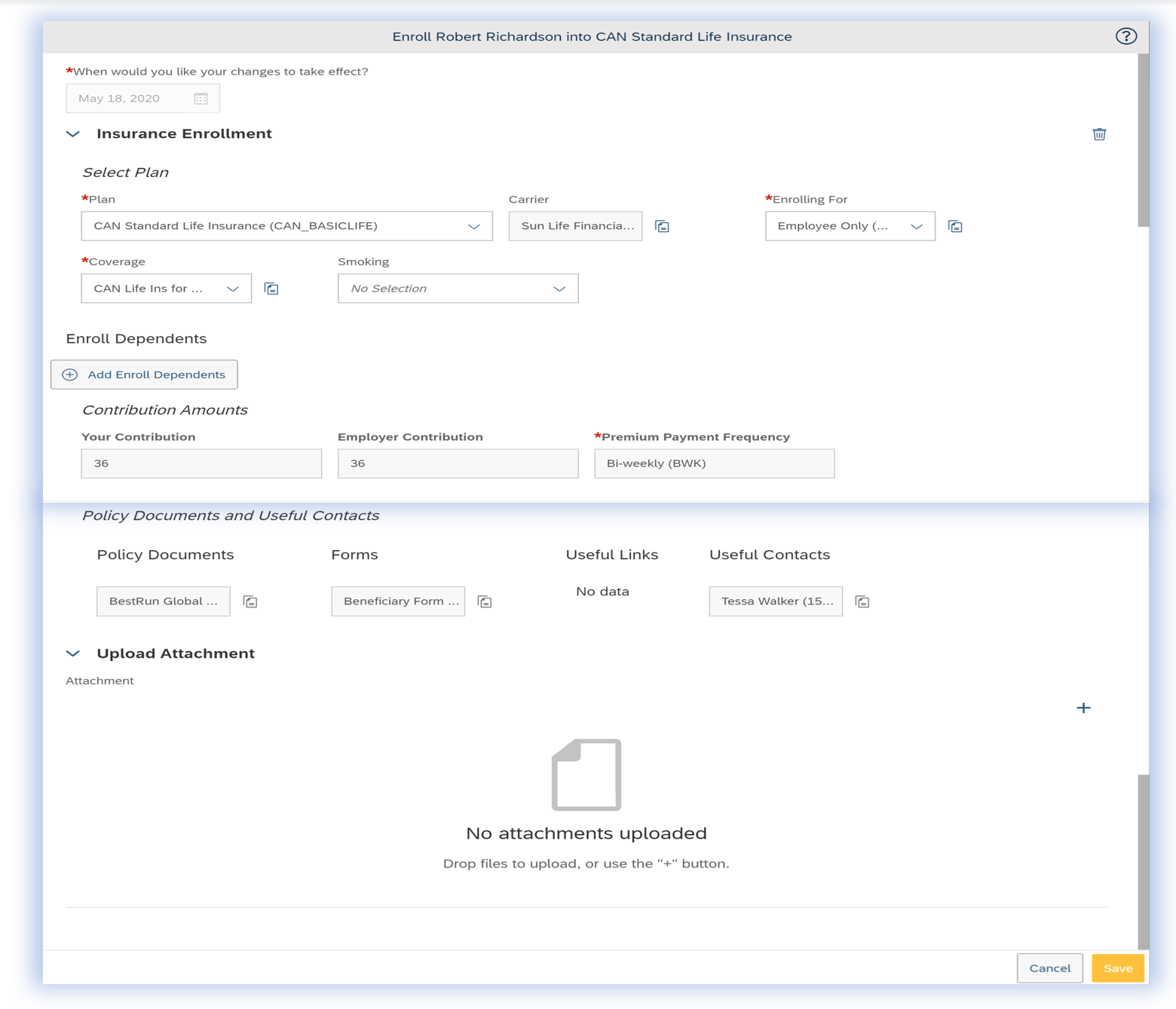

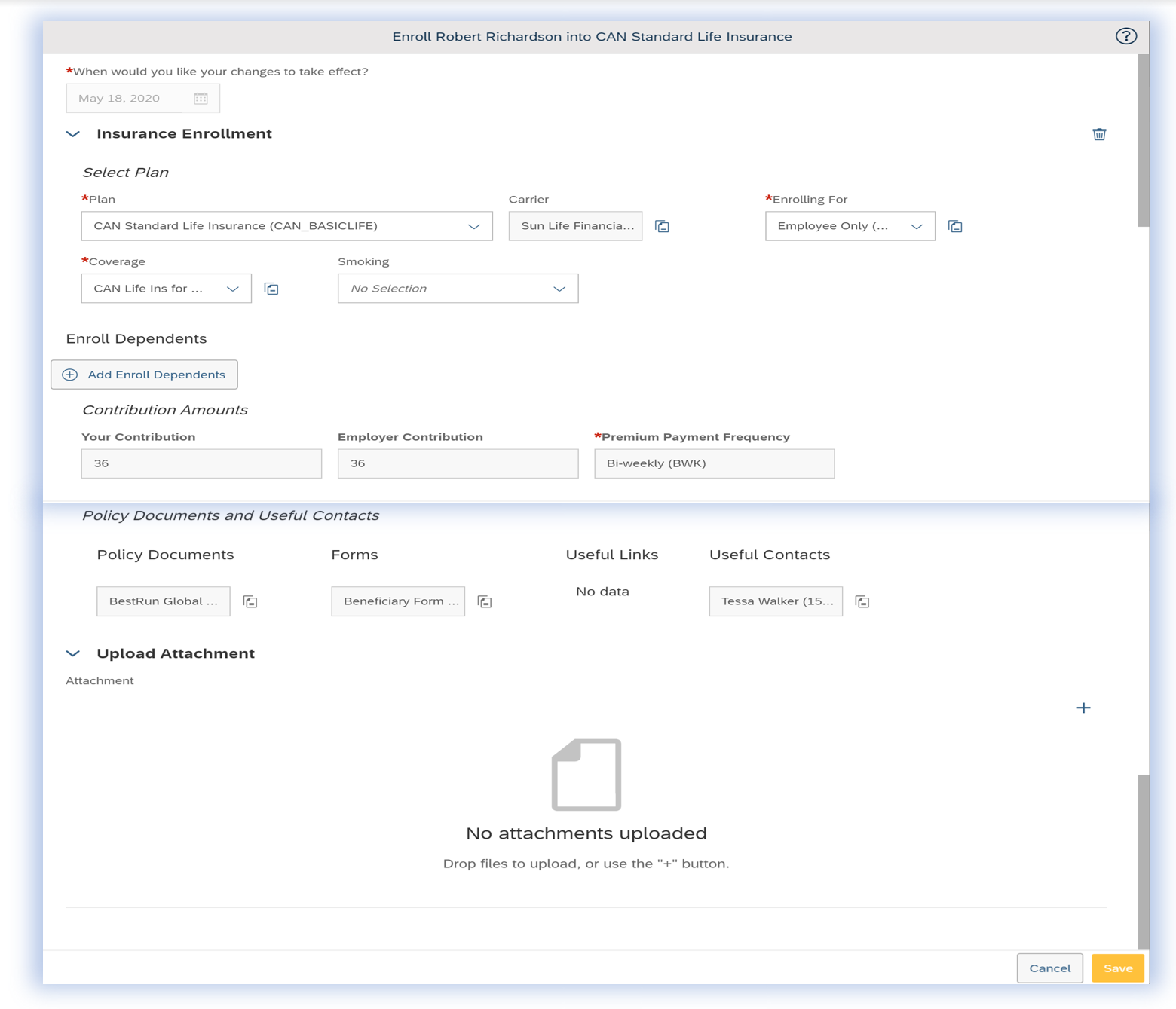

After clicking on the Enroll now button, the enrollment page will open revealing a selection of plan and coverage data. It will then automatically calculate and display the contributions. At the bottom of the page, there is also a section to upload attachments.

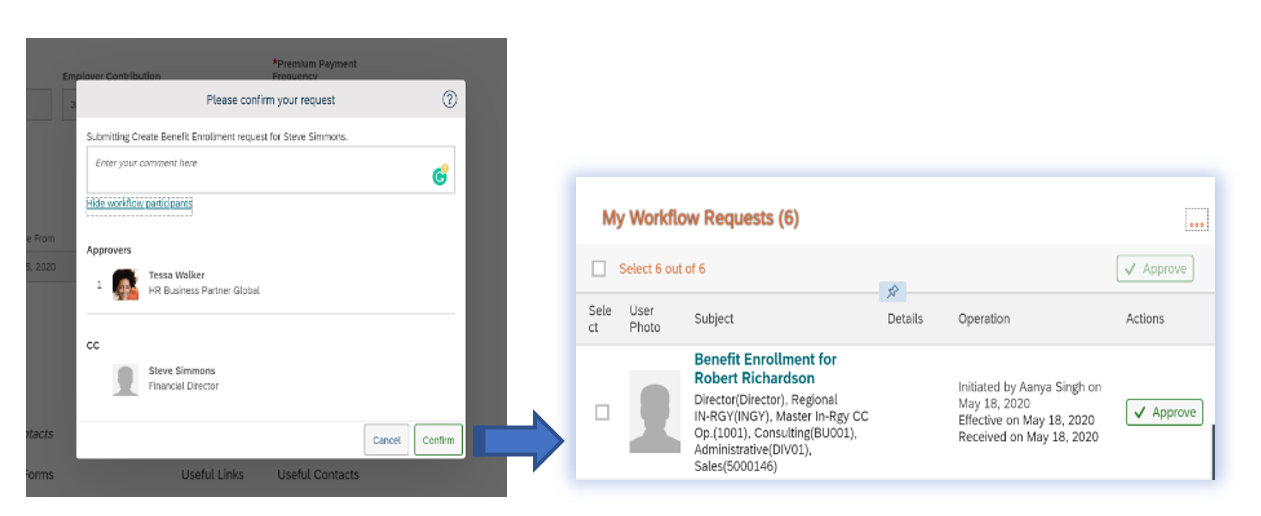

Depending on the policies of the Company, the Benefit could be set up with an approval workflow that is triggered when the enrollment is saved. The approvers have the option to add comments.

The solution uses the standard functionality for SuccessFactors products. So, the approver receives the request in the My Workflow Requests bucket.

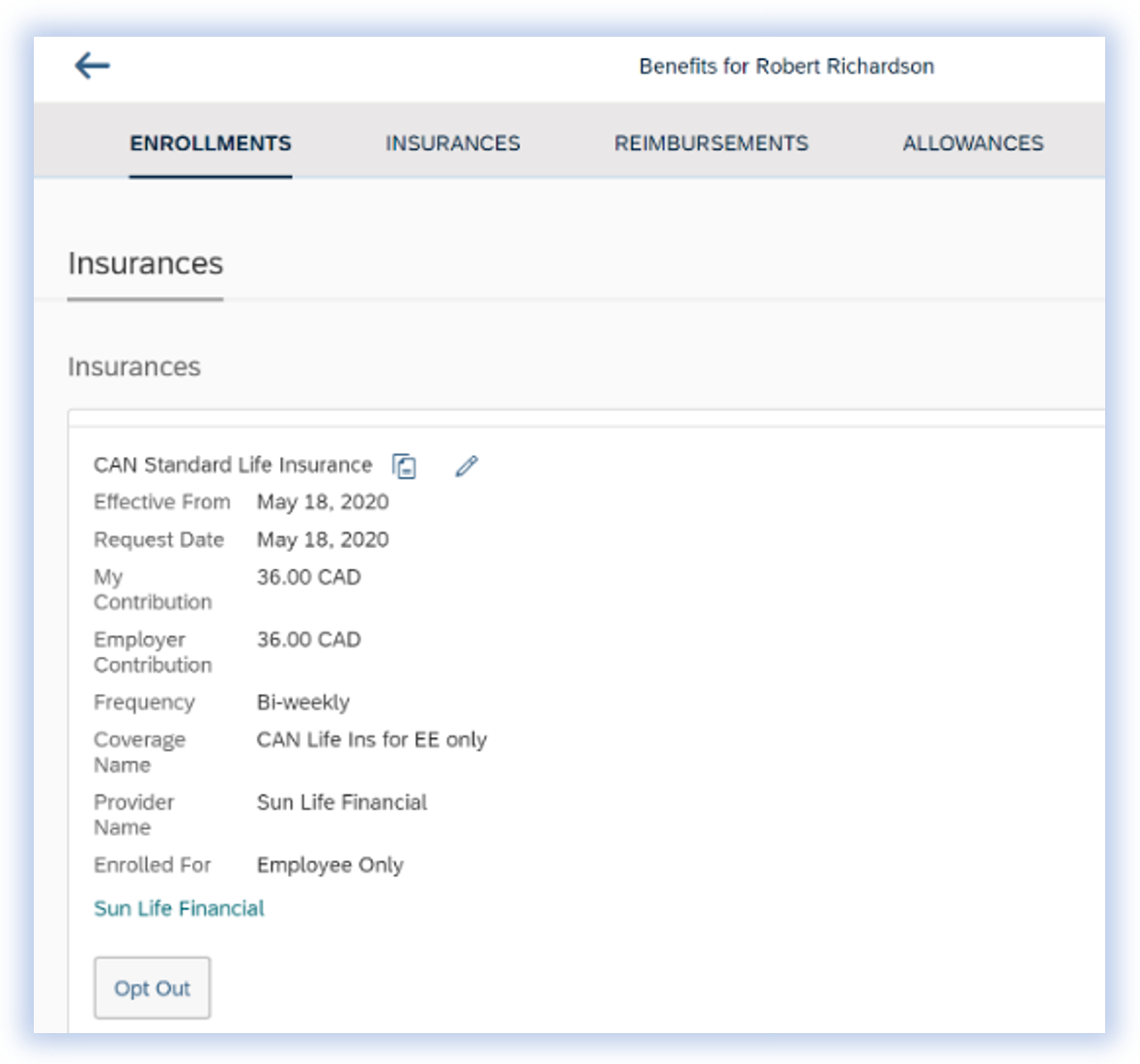

When the Benefit is approved, it will appear in the employee’s My Active Enrollments page.

Here, depending on how the benefit was set up, the insurance could Opt-Out from it.

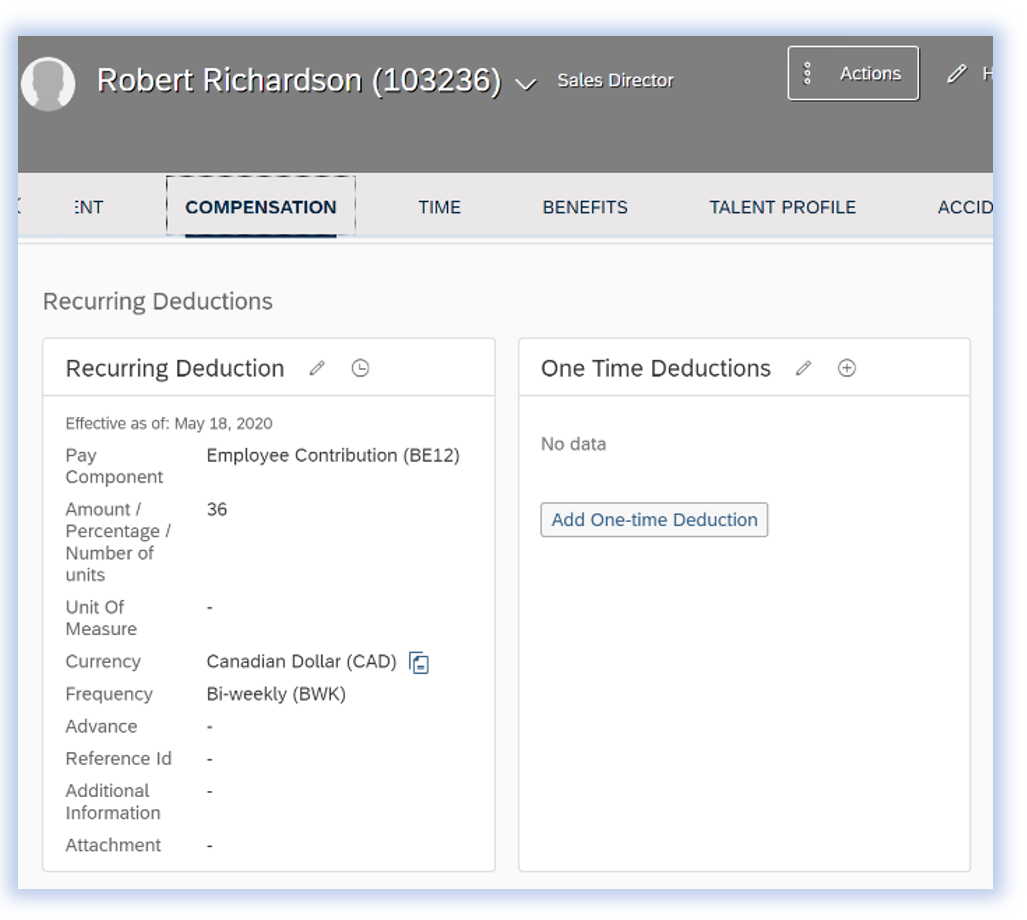

If the insurance has an Employee Contribution, and the Benefit is set up with a Payroll Integration, the amount is going to be sent directly to the Recurring Deductions section in Compensation Info. Now it is ready to be pushed into the SAP Payroll in Infotype 0014 – Recurring Deductions.

The Employer Contribution is found in the Benefits tab and is available to be sent to the Provider. We can use Integration Center, HCI or Advanced Reporting.

Basic Life Insurance in SAP Benefits Management

In SAP, the standard Benefits functionality allows you to customize a diverse range of benefits packages, perform the benefits administration process, handle the benefits master data, and also integrate the results with the payroll component in an easy way.

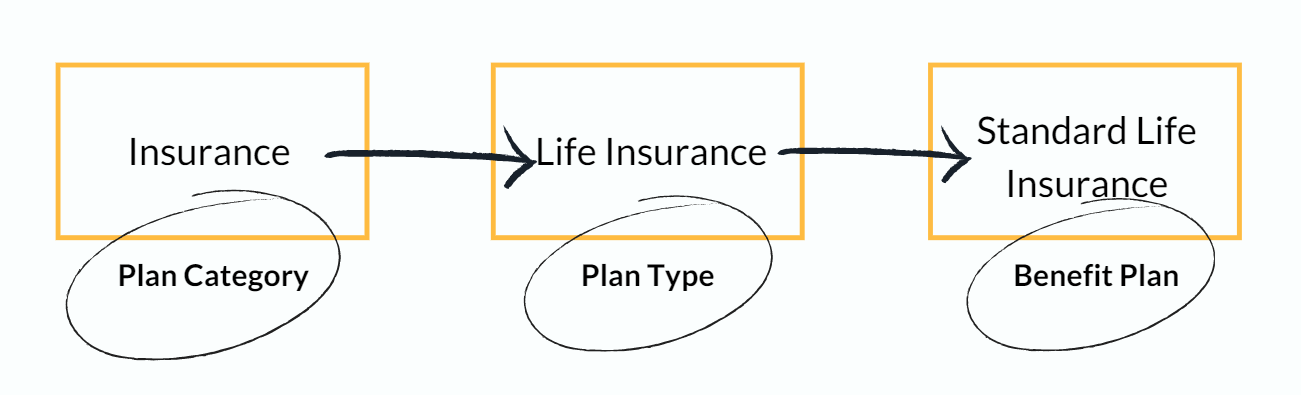

The first step to customize the Basic Life Insurance plan in SAP is to create a Plan Type linked to a Plan Category (provided by SAP), then it is necessary to create the Benefit Plan populating the general data and to create the coverage and cost variants according to the business requirements. In more complex scenarios it is possible to use BAdI enhancements to create custom calculations for the costs of the plan.

After that, it is necessary to include the new Benefit Plan in a Benefit Program, to control the availability and eligibility of the benefits plans according to employee’s grouping definitions.

Finally, there is some additional customizing required to integrate benefits with the Payroll component in SAP to allow both the employee and employer plan cost to be included in employee’s payroll.

Enrollment period

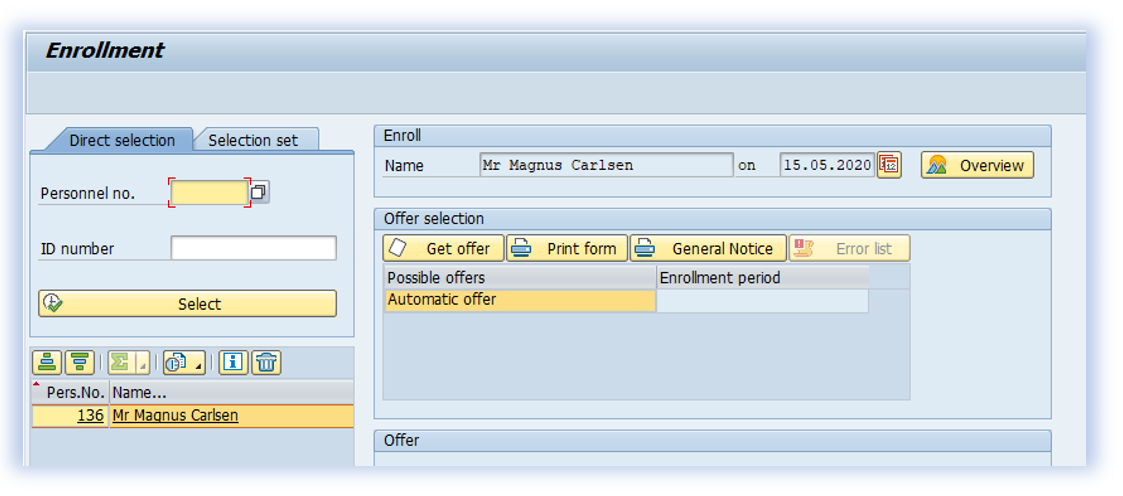

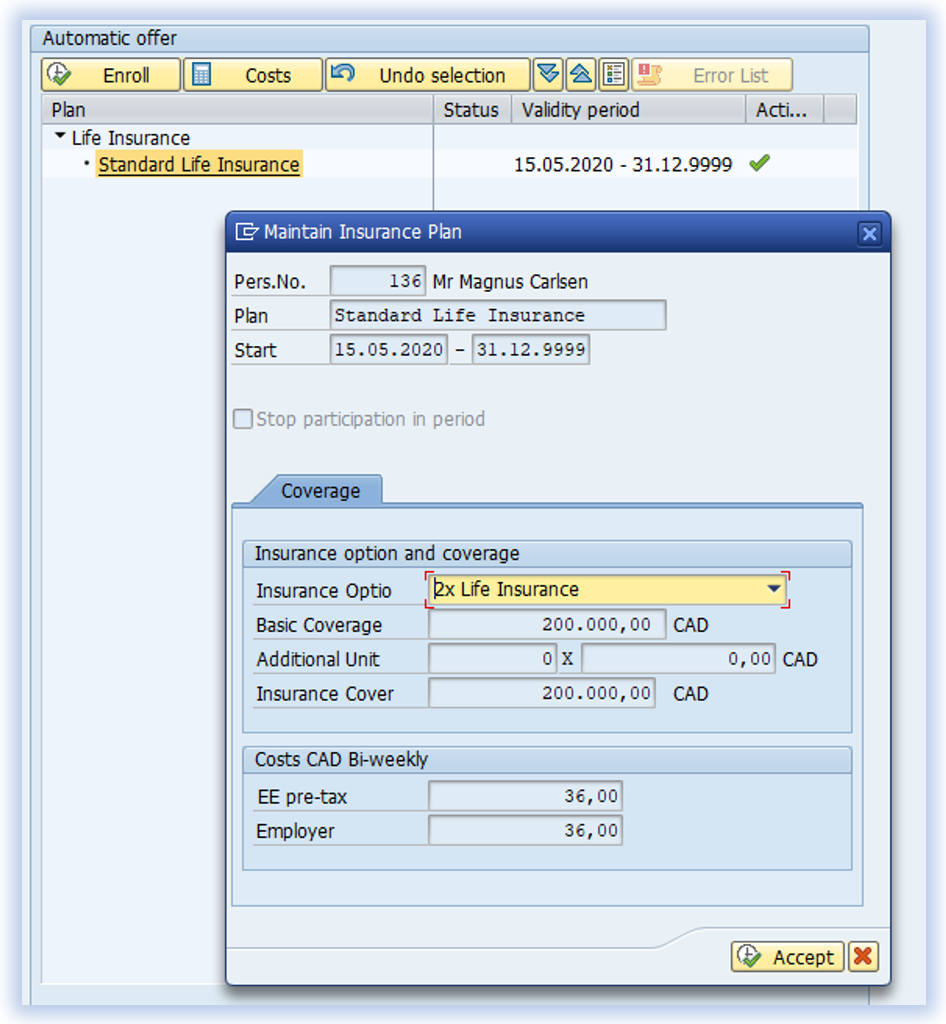

For an open enrollment period, the Benefits Administrator can use the Individual Enrollment transaction in SAP. The system will display a list of offer types that are valid for the employee on the date specified.

In this case, an Automatic Offer was configured for the new life insurance plan. The actual offer is generated when the relevant offer type is selected.

After clicking “Accept” and “Enroll” for the benefit plan, the system checks the employee´s eligibility and validates consistency with customizing definitions, otherwise enrollment cannot be completed.

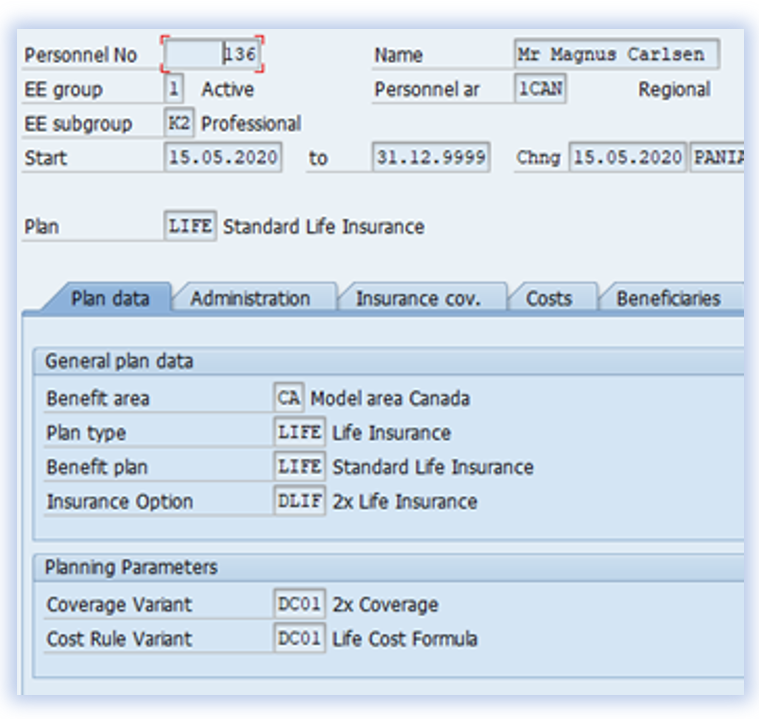

Once enrollment is completed the relevant infotypes are created for the new plan participation. In this case Infotype 0168 is created for the Life Insurance with all the relevant information available in different tabs:

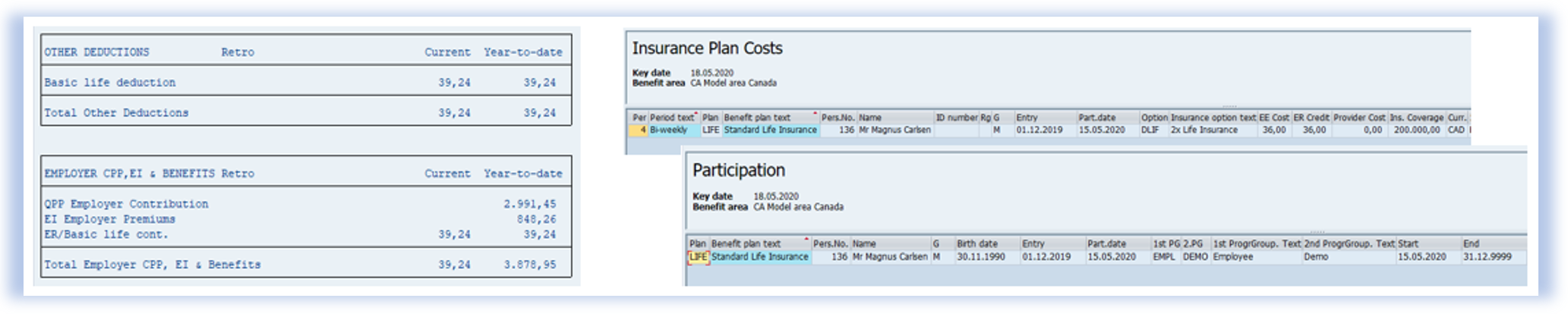

Now the benefit master data is available for further processing in SAP payroll. This calculates the employee deduction and employer contribution. Additionally, it evaluates employee and benefit plan data.

Now that we've gone through the key differences of these solutions, I hope it makes choosing your tool easier.

Want to know more? For additional information, contact our IN-RGY team of experts.

Paola Prida

SAP SuccessFactors consultant