* Ce contenu est disponible en anglais seulement.

Module: SAP Payroll

Country: Canada

The end of the year is approaching, and the Year-End Payroll Process is back on the top of our agendas. Though we carry this task out year after year, it still takes a lot of time and effort if not done optimally. I would like to share three main points of focus to better navigate the process. The three points will help to ease the company's stress and facilitate the entire procedure.

Here are 3 points you should focus on…

Below you will find a list of recommendations to consider during this period. They are based on previous experiences we’ve had with Canadian companies that use SAP as their payroll platform:

1. Make a Plan

Consider this set of activities as a Formal Project. For the first activity, we recommend developing a Work Plan that includes:

-

- Tasks to be performed

- Required target dates

- Owners of each task

This step will help speed up the process, avoid hurdles, and shed a clear, bright light on those responsible for its execution and monitoring.

- Try to list all the activities, not only those related to system set-up. Then align the dates with the last payments, coordinate the off cycles for year-end (if the business has them), and the start of year activities that will be running at the same time. The goal is to have performed all activities before the last day of February and to send the information to the respective Legal Entities on time to avoid penalties.

- Incorporate all the areas involved in this process, the definition of the inputs and outputs of information will give the guideline for those who should be taken into consideration.

- Organize the activities and determine who will be responsible for executing and following up on each task. This dramatically improves communication throughout the entire team.

- Assign enough time for testing to ensure the amounts on the forms are distributed correctly. If an upgrade in the support package is performed, make sure to check if a definition of a set of regression tests causes a need to update other parts of the process.

Some potential additions to the plan (depending on your landscape and conditions) include, but are not limited to:

- Refresh the instance to have data updated

- Develop a back-up plan

- Upgrade the system to the support package level recommended by SAP

- Collect/Validate the information out of the system

- Perform Start of Year Configurations(prepare the system for processing of periods in the upcoming year)

- Set up and/or review the holiday calendar

- Generate and validate work schedules

- Generate and validate period for quotas

- Generate and validate the payroll periods, payment dates and posting dates

- Validate time management and payroll constants

- Generate and validate accrual year for vacations pay

- Adjust the rates for benefits

- Adjust and verify the rates for Workers Compensation Rates

- Adjust provincial and federal tax changes

- Perform the Year-End Configurations for Year-End Reporting

- Mapping new wage types to forms

- Verify employee address

- Apply changes for the tax forms and XML

- Execute the functional test

- Deploy to Production

- Execute an audit of the payroll information and apply relevant adjustments

- Execute Year-End Process and generate year-end reports and the Magnetic Media Files

- Process amendments to Year-end reports

2. Stay Informed

- Be aware of the CRA and Revenue Quebec announcements. Search for the new publications in the websites for CRA and Revenue Quebec for changes impacting reports and forms.

- Review the updates to determine any impact on your processing.

- Review the mapping of relevant wage types to the corresponding T4 and Relevé boxes and ensure that updates, where needed are applied.

The key here is to understand how the information should be reported to accurately explain the new requirements to your IT support. Additionally, to define the required changes and to test properly.

3. Choose a Strategy

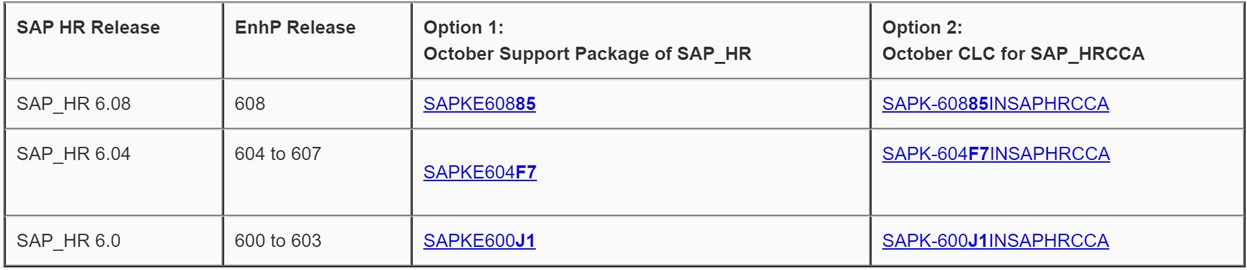

Enhancements are delivered by SAP via SAP notes. Enhancements applicable to Year-end or Start-of-year processing are compiled in an SAP Master Note Year End applicable for the tax year. This Master NOTE for this year was delivered on September 22nd ( SNOTE 2971350 - YE20: Main Note for Canadian Year End 2020 ) and will be regularly updated until the end of the reporting season. SAP requires your system to be at the recommended HR Support Package level applicable in your instance.

The mandatory base HRSP or CLCs for YE2020 are as follows:

Patches (or HR Support Package or HRSP) are a compilation of SAP notes released. For the HR module, SAP releases a Support package monthly. The schedule may be found at the SAP Support Launchpad (Maintenance information)

Another method to apply SAP enhancements is via CLC package (Country Legal Change), which contains all the patches per country if there are big changes cumulated in a certain period, which is the case for our Year-End Process in Canada. If you choose this strategy to update the system, SAP recommends to apply the HR support package called “Synchronization HRSP” in order to continuously maintain the quality and level aligned; this sync SP is delivered sometime in May and November. This option is going to reduce the test efforts and time to perform it.

Another topic to review to determine the strategy is about the tools to execute an audit in the payroll information, for all the earnings, deductions and taxes that already exist in the system. If the tools you are using are not enough to complete this task, you can review some options for 3rd party SAP Partners that have these kind of reports available to implement them in a very short time like Easy Balance by spinifexIT.

Suggestions and topics to discuss your process with your service provider

Keep in mind that the better the subjects are aligned, the smoother the annual process will be:

- Have a plan to track required activities

- Be updated with Legal requirements and coordinate with your IT support relevant changes

- As much as possible, automate your process to have all the information stored in your payroll system integrating the environments to minimize reconciliation

- Spend time to validate the data with the correct tools before sending the magnetic media files

Would you like to know more? For additional information, contact our IN-RGY team of experts.

Paola Prida

SAP SuccessFactors consultant